The best way to predict

the future is to create it.

-Peter Drucker

Our vision

The dynamic growth of information and production technologies creates tremendous potential for the development of new companies and startups. However, there is often a problem with the lack of profitability of these enterprises. It turns out that these organizations have no appropriate business model that allows them to function effectively on the market, acquire and retain loyal customers, as well as manage the company’s finances.

A frequent problem of newly created startups is the lack of cash flow, especially in the first phase of operations. With improper management, many interesting business ideas may not be realized.

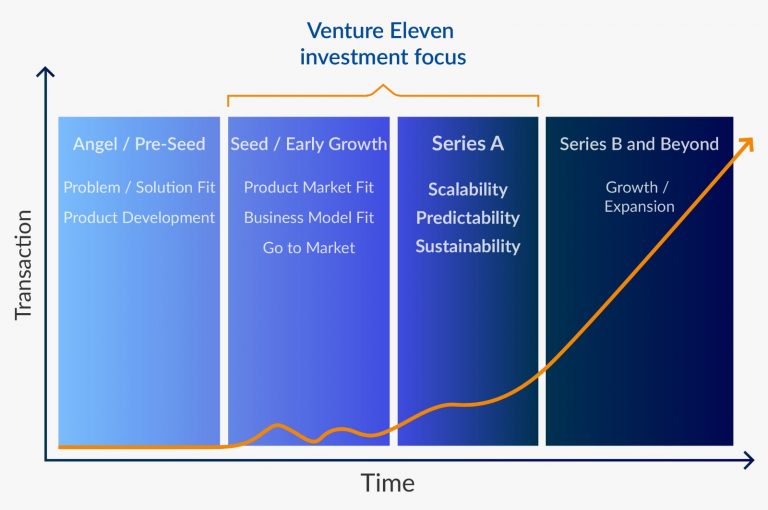

That is why it is so important for us to choose the right business strategy for new ventures. Thanks to our experience and acquired knowledge, we are able to accurately assess the possibilities of developing new projects. By doing in-depth analysis, we invest in companies that have high profitability in the long run.

Who we Are?

Our company – Venture Eleven was founded in 2015. Ever since it has been engaged in in investment activities, such as purchasing blocks of shares or investment projects with expected high rates of return on invested funds. Our main areas of interest are technology, production and industrial sectors. We constantly work on increasing the value of our investment portfolio by active management, acquisitions and strategic partnerships.

It is important for us to care about each project, which is why, apart from investments, we also deal with administration and management issues. An important aspect for us is to realistically assess the development potential of new ventures. In our business, we are not guided by the latest fads or temporary trends. Investment standards and values that we have been faithful to for many years are essential to us. We also believe in loyalty to our business partners, application of proven investment practices, ethics and transparent rules of cooperation.

Range of our activities

What We Do

ACQUISITIONS

We search for profitable companies that are characterized by dynamic development and operate in promising industries

INVESTMENTS

We invest in projects that we believe have great development potential and already have the first clients and revenues

COMPANY DEVELOPMENT STRATEGY

We prepare company development strategies that will strengthen the market position and gain a competitive advantage over the competition.

PROCESS OPTIMIZATION

We improve the efficiency of current business processes in companies.

RESTRUCTURING

We improve the results of the company's operation by modifying the functioning structure and optimizing costs.

STRATEGIC AUDIT

We analyze and evaluate the quality of internal processes in companies. Thanks to an objective view, we develop solutions to improve the operations and profitability of enterprises.

Where We Invest?

Industrial

Profitable companies that have an established position on the market, with an upward trend in terms of revenues and profits

Technology

Technology companies that are characterized by unique ideas, dynamic development and increasing revenues

Sectors in which we invest

Industry 4.0

Production companies, characterized by a high degree of automation and optimization of production processes, with the industry know-how as well as a distinctive way of operating.

Fintech

Companies dealing with technologies for modernizing and automating work in the financial sector.

VR / AR / Mobile Technologies

Companies that create software for multimedia virtual reality. entities that create software dedicated to smartphones and mobile devices.

Real Estate

Commercial properties with with high returns on investment.

IoT

Companies producing software that allows you to control many wireless devices via the internet.

Renewable Energy Sources

Companies dealing in technologies to improve the harvesting of natural, renewable energy sources.

Capital commitment

€100.000 - €5.000.000

Depending on the investment strategy adopted, our capital commitment varies. Venture Eleven’s current investments range from a few percentage points to over 50%. We cooperate with other financial investors on larger projects.

Our Portfolio

Company producing the highest quality windows and doors, providing elegance, comfort and safety.

Company producing digital media & advertising systems. This is a revolutionary method, reaching a broad audience.

A company creating virtual reality software. By using the latest technologies, you can create augmented reality, create and change interior designs, provide driver training programs, as well as computer gaming. There are many interesting and practical applications related to the use of Virtual Reality.

Procell beverage group is a group of companies whose portfolio has only items from the premium beverage segment. Our products always follow the current market trends, because we constantly listen to our clients and try to respond to their needs as quickly as possible.

A revolutionary mobile payment app, which allows you to pay invoices and other documents directly from your mobile device.

Get in touch

Contact Us

VENTURE ELEVEN Sp z o.o.

REGON: 362664828

NIP: 6793117064

KRS: 0000578660

Registered capital: 50.000 PLN

Send Us Query

Friendly atmosphere

for all of your thoughts